Zambia has recently been experiencing droughts, which have significantly impacted the energy sector and led to various negative effects on the economy. This report provides an overview of the energy sector, examines the impact of recent droughts, and identifies opportunities to increase energy generation capacity.

Background.

Zambia has a population of 18 million people and an installed electrical energy capacity of 3,812MW [1]. In 2017, 42% of households had access to electricity, including both the national grid and off-grid solutions [2]. Despite this, only 16.5% of households used electric stoves for cooking, with wood and charcoal biofuels remaining the primary energy sources [2].

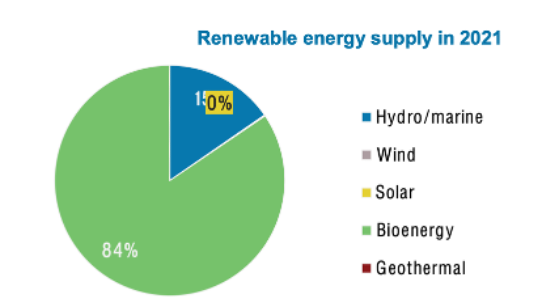

Bioenergy does not constitute a significant portion of Zambia’s installed electrical capacity but remains the largest energy source, primarily in the form of wood and charcoal, which are widely used for cooking, as shown below.

In an ideal scenario, Zambia would generate enough electricity to reduce its dependence on wood and charcoal biofuels. This dependence negatively impacts the environment, increases CO₂ emissions, and causes household air pollution, which is linked to negative health outcomes and higher mortality rates [4], [5]. However, wood and charcoal remain the most accessible energy sources, as most of the population cannot afford cleaner alternatives.

The next sections will explore the effects of energy deficits caused by droughts and opportunities for expanding energy generation capacity.

Impact of Recent Droughts on the Energy Sector and Their Knock-On Effects

In 2023/2024, Zambia experienced droughts that directly impacted various sectors of the economy, including agriculture and the energy sector, which relies heavily on water availability [6]. These droughts have also indirectly affected other areas. This section focuses on how the energy sector has been impacted and the resulting effects on other industries.

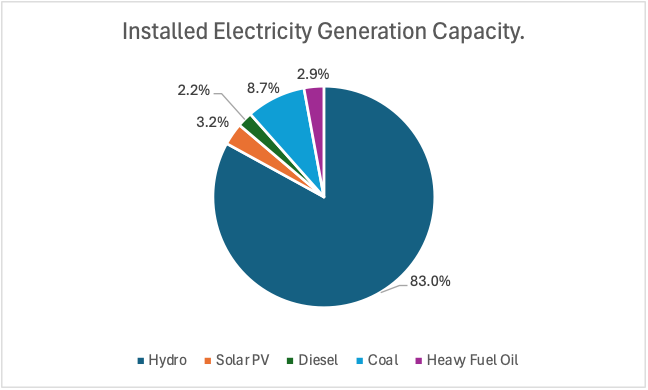

Figure 2- Zambia’s Energy Sources [1].

Zambia’s largest source of electricity is hydropower, which accounts for 83% of the country’s installed capacity. This heavy reliance on hydropower has made Zambia particularly vulnerable to the effects of climate change.

Due to the recent droughts, the Kariba Dam—Zambia’s largest hydroelectric scheme—was severely affected, delivering only 7% of its 1,080 MW capacity [7]. Consequently, ZESCO, the government-owned power utility company, implemented 8-hour daily load-shedding schedules in March 2024, which increased to 12 hours daily in May 2024 [8], [9].

The droughts have also had knock-on effects on other industries.

Load-shedding is generally accompanied by water supply disruptions, as water suppliers need electricity to treat, pump, and distribute water. This negatively affects businesses and the rest of the population.

The mining sector has also been impacted by the unreliable electricity supply, leading copper producers to cut back on production [10]. This is a problem because copper accounts for the largest share of Zambia’s export revenue, making up as much as 69% of the export market in 2022 [11].

Zambian telecommunications are also affected by load-shedding. Telecommunication companies generally rely on batteries and generators to continue operating during power cuts, with backup systems originally designed to provide power for up to 4 hours [12]. However, 12-hour load-shedding schedules have led to frequent network disruptions, higher operational costs, and a decline in mobile service quality [13].

Small businesses, which often lack the resources to cost-effectively install alternative energy solutions, have also been impacted.

The effects of the droughts on various sectors of the economy have contributed to a depreciation of the kwacha, with inflation reaching as high as 15% in the past six months [10].

Opportunities for Increasing Zambia’s Energy Generation Capacity.

Zambia’s current energy generation capacity is insufficient to provide electricity to most of the population. Additionally, the recent droughts have highlighted the need for a more resilient energy grid. Addressing these challenges requires Zambia to expand its energy generation capacity to serve underserved populations and diversify its energy mix, making the national grid more resilient to the effects of climate change. This section explores opportunities for expanding Zambia’s energy generation capacity and compares the costs of different energy sources.

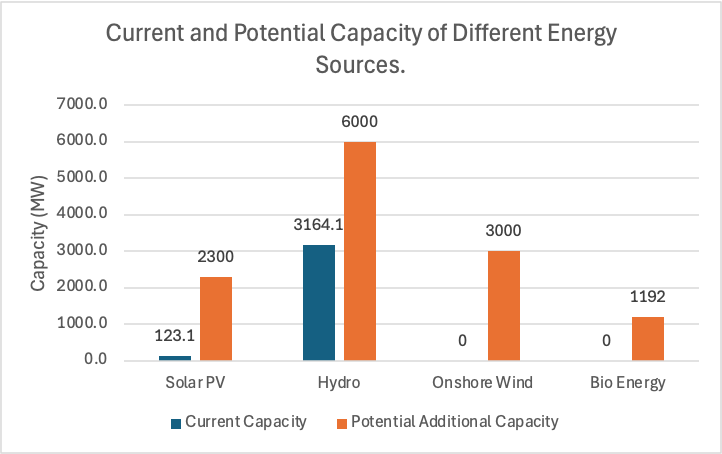

Zambia has significant potential to expand its energy generation capacity in solar PV, onshore wind, hydropower, and biomass. Currently, onshore wind and biomass do not contribute to the national grid, but they have the potential to enhance overall energy capacity. Figure 3 shows the current installed capacity and the potential additional capacity of these energy sources. The largest opportunity lies in hydropower, which has the potential to significantly expand generation capacity.

Figure 3 – Zambia’s Current and Potential Additional Energy Generation Capacity [1], [3], [14], [15], [16].

Levelised Cost of Energy (LCOEs) for Zambia.

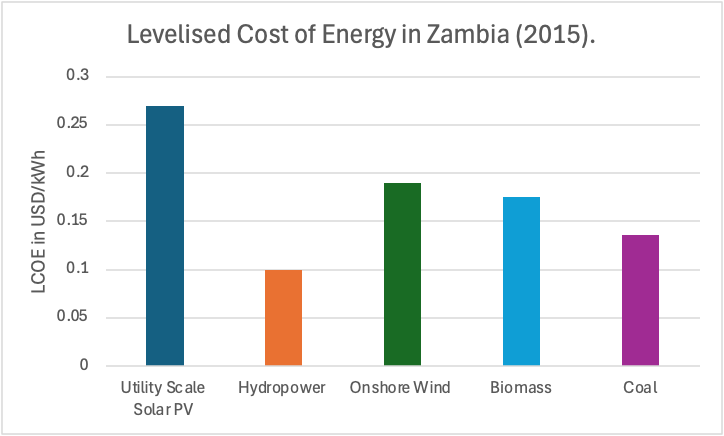

Levelised Cost of Energy (LCOE) is the ratio of the overall lifetime costs of an energy project to its total lifetime energy output. It is a useful metric for comparing the costs of different energy projects. The figure below shows the LCOEs of various energy sources.

Figure 4 – LCOEs for Different Energy Sources in Zambia [17].

Utility-scale PV systems had an LCOE of 0.27 USD/kWh in 2015. As they feed directly into the grid and are implemented at a larger scale of at least 1 MW, this helps to reduce costs.

In contrast, off-grid solar PV systems with battery storage—usually deployed on a smaller scale—had an average LCOE of 1.6 USD/kWh in 2019 [16].

Hydropower.

Figure 5 – The Kariba Dam.

Hydropower is Zambia’s main source of electricity and has significant potential to expand the country’s energy generation capacity. Of Zambia’s 6,000 MW of hydropower potential, only 30% is currently being harnessed[15].

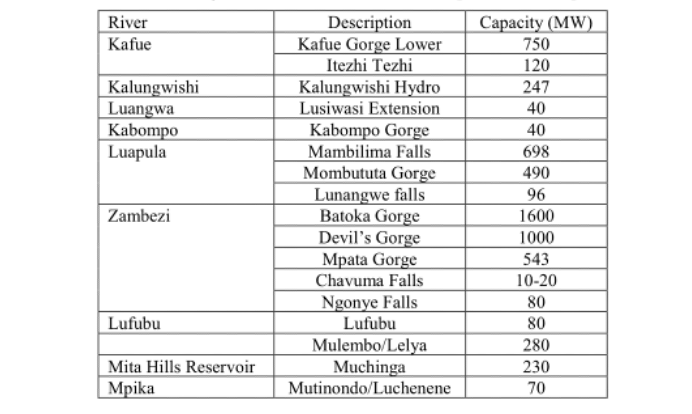

The table below shows some of the potential hydropower sites.

Figure 6-Potential Hydropower sites [15].

Recent droughts have shown that primarily relying on hydropower threatens energy security. Despite this, hydropower will remain an important resource to invest in, as it has the potential to deliver the largest capacity with the lowest LCOE. Additionally, it produces lower emissions compared to sources like biomass, coal, or gas.

Onshore Wind.

Figure 7 – An Onshore Wind Farm.

Onshore wind is relatively new to Zambia, which currently has no installed capacity. In a study that identified eight viable wind farm sites, the Lusaka site showed the greatest potential, with the lowest LCOE and the highest average wind speed of 8 m/s compared to the other sites [18].

For a site to be commercially viable, it needs to have annual average wind speeds of at least 6.5 m/s at 80 m heights. The eight sites identified had annual average wind speeds ranging from 6.9 to 8 m/s [18]. Expected LCOEs ranged from 0.182 to 0.235 USD/kWh across the different sites [19].

Wind energy does, however, face several challenges. Its supply is variable, requiring significant storage capabilities, and it is the second most expensive energy source in Zambia after utility-scale solar PV plants. Nonetheless, if Zambia aims to diversify its energy grid, onshore wind is worth exploring, as it is the second largest resource after hydropower.

Solar PV.

Figure 8 – A Solar PV Farm.

Zambia shows significant potential to expand its solar PV generation capacity, with up to 2,300 MW of potential. The country receives an average of 6-8 hours of sunshine per day, totalling 4,400 hours of sunshine per year, and a high monthly average solar radiation incident rate of 5.5 kWh/m²/day [15].

For a long time, the solar PV market in Zambia did not include utility-scale solar PV plants but focused mainly on home solar systems, off-grid and mini-grid electricity systems, and donor-funded projects targeting the health sector [14]. Recently, however, some utility-scale solar PV projects have been commissioned. These include a 47 MW solar plant by Neon (French) and First Solar (American) in 2019, and a 26 MW solar project by Enel (Italian) commissioned in 2020 [14].

Solar PV has similar challenges to onshore wind. It is the most expensive energy source in Zambia and has a variable supply, requiring significant storage capabilities. However, solar PV can play a unique role in increasing electricity access.

Zambia has an area of 752,610 square kilometres and a population of 19.6 million (as of 2021) [20], [21]. A significant proportion of the population, 43.3%, lives in urban areas, while the rest of the country is sparsely populated [22].

As most of the country is sparsely populated, connecting the various remote communities across long stretches of land to the national grid may not be the most efficient or cost-effective solution due to high infrastructure costs, energy losses, and the small sizes of these populations. In such cases, off-grid solar PV systems may be the most effective solution.

However, off-grid solar PV systems are more expensive than utility-scale PV systems, making it more challenging to establish a viable business case for them, especially in rural areas where most people live below the poverty line [22].

Bioenergy.

Figure 9 – Maize Field.

Bioenergy contributes 70% to Zambia’s total energy demand [16]. However, due to current extraction methods, most of the biomass use is unsustainable and has resulted in deforestation rates of 79,000 to 150,000 hectares per year, gradually reducing the 44.8 million hectares of forested land [23]. Current extraction methods are being used largely because wood fuel and charcoal are affordable, easily accessible and serve as a significant source of income for about 500,000 people [16]. Another contributing factor is that most of the population does not have access to electricity, and load shedding forces households to supplement their energy needs with wood and charcoal biofuels.

Despite these challenges, there are more sustainable ways to extract biomass, particularly from agricultural waste and forest residues. When harnessed sustainably, biomass can be used to generate electricity, create fuels for cooking, and support transportation needs. Briquettes and biogas have the potential to provide 14% of the country’s clean cooking fuel [16]. Additionally, Zambia has the potential to generate 1,192 MW of electricity, primarily from agricultural waste [16]. However, there is no clear data on the current installed electricity generation capacity.

Biomass also has the potential to provide off-grid electricity for underserved communities, with the capacity to meet the demand of up to 2.94% of rural households [16]. Furthermore, biomass has a lower LCOE than onshore wind and solar PV, making it an important option to consider for diversifying Zambia’s energy mix.

Challenges Posed by Subsidised ZESCO Tariffs.

Figure 10 – Power Transmission Lines.

To understand the challenges, it is essential to first examine the structure of ZESCO. ZESCO is a vertically integrated power utility company owned by the Zambian government. It owns power stations and installs and maintains transmission lines and distribution networks [14]. Zambia operates a single-buyer electricity market in which ZESCO is the off-taker and bulk retailer of electricity. Independent power producers generate electricity and operate their own assets but must sell to ZESCO through power purchase agreements to access ZESCO’s distribution networks [14]. However, independent power producers can generate and distribute power independently if they operate off-grid [14]. The Energy Regulation Board (ERB), established by the government, is responsible for setting ZESCO’s tariffs [24].

Over the past decade, ZESCO has incurred losses due to government-mandated subsidised tariffs. In 2016 alone, subsidies in the electricity sector cost the government $576 million [25]. In 2014, Zambia had some of the lowest tariffs in Sub-Saharan Africa, with rates up to four times lower than those of neighbouring countries. In 2017, the government announced intentions to introduce cost-reflective tariffs, leading to a 75% tariff increase that year [25]. However, these increases did not apply to the mining sector, Zambia’s largest consumer of electricity, which accounts for up to 51% of consumption [26].

One of the main challenges of subsidised tariffs is the lack of additional revenue for reinvestment in the energy sector. It also hinders private investment, especially when off grid independent power producers must compete with ZESCO’s subsidised tariffs.

Despite the challenges posed by subsidies, completely eliminating them does not currently seem to be a viable option. For instance, the blanket tariff increase proposed by ZESCO to the ERB in 2020 was estimated to push 180,000 people below the poverty line [27]. Therefore, some level of support will still be necessary for the poorest consumers. However, if not properly targeted, subsidies may benefit groups outside the intended recipients, such as high-income consumers or the mining sector, leading to inefficient government spending. There needs to be a balance between implementing cost-reflective tariffs and protecting low-income consumers.

A Reason to Hope.

It is evident that Zambia needs to expand and diversify its electricity generation capacity. The current government has set plans to expand generation capacity to 4,457 MW by 2026 [28]. So far, Zambia has increased its generation capacity from 3,307 MW in 2021 to 3,812 MW in 2023 [1], [28]. Zambia will ideally continue on this trajectory.

Zambia has entered into several significant partnerships to expand its energy generation capacity. The first notable deal is ZESCO’s partnership with Integrated Clean Energy Power Company Ltd to install 2,400 MW of renewable electricity, worth $3.5 billion [28]. Another significant agreement has been made with Masdar from the UAE for the installation of 2,000 MW of solar energy, valued at $2.5 billion [28]. Although the Masdar solar energy project is underway, there have been some significant delays [29]. Additionally, the UK private sector and government have announced plans to raise £3 billion to invest in Zambia’s mining and renewable energy sectors [30], [31].

Another important initiative is the government’s 1,000 Mini-Grid Initiative, supported by The Rockefeller Foundation, Sustainable Energy for All, and the Global Alliance for People and Planet [32]. This is a grant-based subsidy that aims to incentivise mini-grid developers to provide electricity services in rural communities that cannot be feasibly connected to the national grid.

Conclusion.

Zambia’s energy sector faces significant challenges, primarily due to its heavy reliance on hydropower, which has proven vulnerable to the impacts of climate change. Recent droughts have underscored the need for a more resilient and diversified energy mix. Expanding electricity generation capacity is crucial not only to meet growing demand but also to reduce dependence on environmentally damaging biofuels.

The country has substantial potential in renewable energy sources, including solar PV, onshore wind, and biomass, which could contribute to a more reliable and sustainable energy grid. Strategic investments and international partnerships are already paving the way for increased capacity and infrastructure development. However, achieving energy security will require balanced tariff reforms, targeted subsidies to protect low-income consumers, and continued investment in off-grid solutions for rural areas.

By diversifying its energy mix and adopting sustainable practices, Zambia has the opportunity to enhance energy security, stimulate economic growth, and improve the quality of life for its citizens. The road ahead is challenging, but the potential rewards make it a journey worth pursuing.

Reference List.

[1] Energy Regulation Board, “Mid-Year Statistical Bulletin,” 2023. Accessed: Jan. 24, 2025. [Online]. Available: https://www.erb.org.zm/wp-content/uploads/midYearStatBullet2023.pdf

[2] World Bank, “Zambia Beyond Connections Energy Access Diagnostic Report Based on the Multi-Tier Framework.” Accessed: Jan. 10, 2025. [Online]. Available: https://documents1.worldbank.org/curated/en/477041572269756712/pdf/Zambia-Beyond-Connections-Energy-Access-Diagnostic-Report-Based-on-the-Multi-Tier-Framework.pdf

[3] IRENA, “Energy Profile Zambia,” 2024. Accessed: Jan. 24, 2025. [Online]. Available: https://www.irena.org/-/media/Files/IRENA/Agency/Statistics/Statistical_Profiles/Africa/Zambia_Africa_RE_SP.pdf

[4] World Health Organisation, “Household Air Pollution.” Accessed: Jan. 25, 2025. [Online]. Available: https://www.who.int/news-room/fact-sheets/detail/household-air-pollution-and-health

[5] E. N. Chidumayo and D. J. Gumbo, “The environmental impacts of charcoal production in tropical ecosystems of the world: A synthesis,” Energy for Sustainable Development, vol. 17, no. 2, pp. 86–94, Apr. 2013, doi: 10.1016/j.esd.2012.07.004.

[6] Lusaka Times, “President Hichilema Declares Drought As A National Disaster and Emergency.” Accessed: Jan. 09, 2025. [Online]. Available: https://www.lusakatimes.com/2024/03/01/president-hichilema-declares-drought-as-a-national-disaster-and-emergency/

[7] K. Gondwe, “How a mega dam has caused a mega power crisis for Zambia.” Accessed: Jan. 10, 2025. [Online]. Available: https://www.bbc.co.uk/news/articles/cx2krr137x9o

[8] Lusaka TImes, “8 hour Load Shedding In Zambia Begins.” Accessed: Jan. 09, 2025. [Online]. Available: https://www.lusakatimes.com/2024/03/11/8-hour-load-shedding-in-zambia-begins/

[9] P. Daka, “Govt finally announces 12-hour load shedding schedule.” Accessed: Jan. 09, 2025. [Online]. Available: https://diggers.news/business/2024/05/24/govt-finally-announces-12-hour-load-shedding-schedule/

[10] Mfula, “Zambia’s currency stuck at record low as drought persists.” Accessed: Jan. 09, 2025. [Online]. Available: https://www.reuters.com/markets/currencies/zambias-currency-stuck-record-low-drought-persists-2025-01-08/

[11] G. Baskaran and F. Yu, “Recommendations for Building Zambia’s Copper Industry.” Accessed: Jan. 09, 2025. [Online]. Available: https://www.csis.org/analysis/recommendations-building-zambias-copper-industry

[12] A. Ranjan, “Zambia’s Telecom Sector Hit Hard by Severe Loadshedding Crisis.” Accessed: Jan. 23, 2025. [Online]. Available: https://techafricanews.com/2024/07/11/zambias-telecom-sector-hit-hard-by-severe-loadshedding-crisis/#:~:text=With%20over%203%2C500%20towers%20connected,hours%20daily—have%20strained%20resources.

[13] J. Kayombo and J. Mbale, “The Impact of Power Load Shedding on Mobile Service Providers in Kitwe, Zambia,” Journal of Electrical Systems , vol. 20, pp. 74–78, 2024, Accessed: Jan. 23, 2025. [Online]. Available: https://www.researchgate.net/publication/386900325_The_Impact_of_Power_Load_Shedding_on_Mobile_Service_Providers_in_Kitwe_Zambia

[14] International Trade Administration, “Zambia – Country Commercial Guide.” Accessed: Jan. 10, 2025. [Online]. Available: https://www.trade.gov/country-commercial-guides/zambia-energy

[15] M. Mwanza, J. CHAKCHAK, N. S. ÇETIN, and K. ÜLGEN, “Assessment of Solar Energy Source Distribution and Potential in Zambia,” Periodicals of Engineering and Natural Sciences (PEN), vol. 5, no. 2, Mar. 2017, doi: 10.21533/pen.v5i2.71.

[16] FAO, “SUSTAINABLE BIOENERGY POTENTIAL IN ZAMBIA,” 2020. Accessed: Jan. 23, 2025. [Online]. Available: https://openknowledge.fao.org/server/api/core/bitstreams/ddf8c0c3-2686-4110-ad9b-8332606b1741/content

[17] S. Henbest, L. Mills, A. Sarhel, and R. Pathania, “levelised cost of energy dfid 28 priority countries,” 2015, Accessed: Jan. 23, 2025. [Online]. Available: https://assets.publishing.service.gov.uk/media/57a08991e5274a31e0000154/61646_Levelised-Cost-of-Electricity-Peer-Review-Paper-FINAL.pdf

[18] Centre for Sustainable Systems, “Wind Resource and Potential.” Accessed: Jan. 26, 2025. [Online]. Available: https://css.umich.edu/publications/factsheets/energy/wind-energy-factsheet

[19] S. Mutale, Y. Wang, J. Yasir, A. Banda, and T. Aboubacar, “Exploring the economic prospects of wind energy in Zambia,” International Journal of Sustainable Engineering, vol. 17, no. 1, pp. 554–569, Dec. 2024, doi: 10.1080/19397038.2024.2371404.

[20] World Bank, “Surface Area (Sq.km) Zambia.” Accessed: Feb. 12, 2025. [Online]. Available: https://data.worldbank.org/indicator/AG.SRF.TOTL.K2?locations=ZM

[21] World Bank, “The World Bank in Zambia.” Accessed: Feb. 12, 2025. [Online]. Available: https://www.worldbank.org/en/country/zambia/overview#1

[22] World Bank, “Zambia Urbanisation Review: Leveraging Cities and Towns for Zambia’s Future.” Accessed: Feb. 12, 2025. [Online]. Available: https://documents1.worldbank.org/curated/en/099410012022220621/pdf/P1777290c949c70c9082a008455f0bdd8a9.pdf

[23] European Commission, “Forest Partnerships with the European Union- Zambia.” Accessed: Feb. 12, 2025. [Online]. Available: https://international-partnerships.ec.europa.eu/system/files/2022-11/forest-partnership-factsheet-Zambia.pdf

[24] K. Bayliss and G. Pollen, “The power paradigm in practice: A critical review of developments in the Zambian electricity sector,” World Dev, vol. 140, p. 105358, Apr. 2021, doi: 10.1016/j.worlddev.2020.105358.

[25] Bridle Richard, M. Halonen, M. Klimscheffskij, C. Mukumba, and Siwabamundi Charity, “3.0 Fossil Fuel and Electricity Subsidies in Zambia,” pp. 4–6, 2018, Accessed: Feb. 13, 2025. [Online]. Available: https://www.jstor.org/stable/resrep21996.5

[26] Ministry of Energy, “Energy Sector.” Accessed: Jan. 09, 2025. [Online]. Available: https://www.moe.gov.zm/?page_id=2198

[27] CUTS International, “Targeting Residential Electricity Subsidies in Zambia,” 2020. Accessed: Feb. 13, 2025. [Online]. Available: https://cuts-lusaka.org/pdf/policy-brief-targeting-residential-electricity-subsidies-in-zambia.pdf

[28] IDC, “Renewable Energy, A Game Changer for Zambia.” Accessed: Feb. 06, 2025. [Online]. Available: https://www.idc.co.zm/idc-congratulates-zesco-for-signing-a-major-power-agreement/

[29] T. Muchiya, “$2 billion MASDAR solar power project stalls.” Accessed: Feb. 06, 2025. [Online]. Available: https://zambianbusinesstimes.com/2-billion-masdar-solar-power-project-stalls/#:~:text=The%20%242%20billion%20deal%20between,sustainable%20development%20in%20the%20country.

[30] Foreign Commonwealth & Development Office and J. Cleverly, “UK supports green growth in Zambia,” 2023, Accessed: Feb. 06, 2025. [Online]. Available: https://www.gov.uk/government/news/uk-supports-green-growth-in-zambia

[31] Foreign Commonwealth & Development Office and A. Dodds, “UK Development Minister focuses on ‘Driving Growth’ in trip to Malawi and Zambia.” Accessed: Feb. 06, 2025. [Online]. Available: https://www.gov.uk/government/news/uk-development-minister-focuses-on-driving-growth-in-trip-to-malawi-and-zambia#:~:text=Reaffirming%20UK%27s%20commitment%20to%20the,Understanding%20on%20energy%20sector%20support.

[32] Global Alliance for People and Planet, “Zambian Government and Partners Unveil New Financial Mechanism to Accelerate Energy Access through Mini-Grids.” Accessed: Feb. 13, 2025. [Online]. Available: https://energyalliance.org/zambian-government-partners-unveil-new-financial-mechanism-accelerate-energy-access-minigrids/